Transformation

Schaffer Consulting helps clients make profound shifts that rapidly transform their organization.

Transformation is hard. Success requires engaging the full organization in establishing new ways of working and creating value. Schaffer’s results-driven approach enables organizations to perform while they transform.

Our proven methodologies, such as Rapid Results and WorkOut, engage and empower people closer to the work in fast-paced experimentation and learning. Teams question how things are done, rethink what is possible, and deliver breakthrough results.

Our work addresses a broad portfolio of strategic priorities. Examples include:

Schaffer Methodologies

Rapid Results

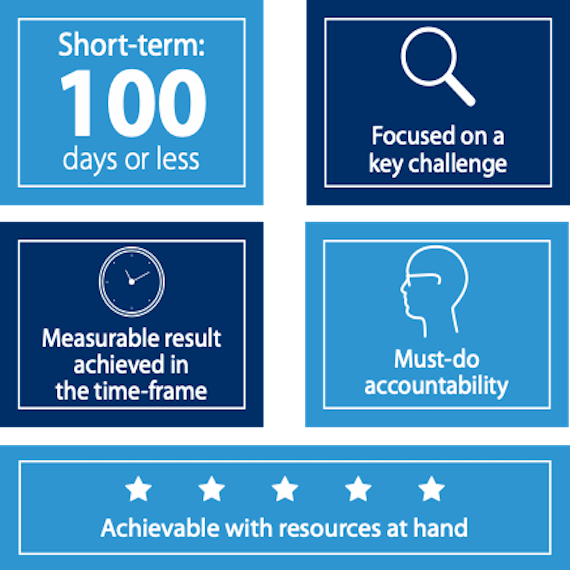

The core of Rapid Results involves working with leaders and teams to set and achieve aggressive goals in one or more key areas of performance. In these scenarios, companies are compelled to tap into hidden reserves of capacity and energy to get the job done, and they must take action and test assumptions to demonstrate how to enter a new market, sell a new product, or deliver better service. Through a succession of these fast-paced, results focused initiatives, companies make dramatic gains toward major goals.

Because Rapid Results makes the best use of existing knowledge and resources, it’s fast and cost-effective. And because internal teams execute the projects with structured coaching from Schaffer along the way, team members build new capabilities through the achievement of measurable outcomes. Ultimately, Rapid Results generates both the momentum and the expertise to accelerate and sustain major change.

Workout

WorkOut—which Schaffer Consulting developed in collaboration with GE—sets the stage for organizations to tackle large, complex business problems quickly and decisively. It is a large-scale transformation event that brings together diverse teams from various business functions and levels to collaboratively address a critical business issue. Over the course of a day or two, the teams develop recommendations for making measurable improvements toward a well-defined, ambitious performance goal or objective. Those recommendations are presented to senior leaders who make on-the-spot yes or no decisions. Teams are then empowered to implement the recommendations and are expected to deliver tangible, measurable results in 100 days or less.

WorkOut accelerates the pace of change by cutting through bureaucracy and promoting innovative thinking and bold decision making. It aligns the organization cross functionally to work collaboratively toward major results improvement. Most importantly, it mobilizes organizations to take immediate action toward generating needed results and major organization change.

Areas of Focus

Organic Growth

Our clients are impatient to drive growth. Impatient to kick start new product development. To expand more quickly into new markets. To deliver greater value to customers.

But many organizations have trouble breaking through the pattern of analysis and planning. Critical top line challenges, such as improving new product development or expanding major customer relationships, become more about activities than results, costing time and blurring focus. Promising growth ideas become obscured, their potential buried or delayed.

Our approach equips clients to overcome these challenges. We help to accelerate growth by zeroing in on high-impact projects: Projects with leverage. Projects to win major accounts. That generate a burst of new product sales. That enrich customer relationships. That drive revenue.

We work closely with teams to translate those projects into bottom-line results in rapid time frames, helping them to develop new capabilities that multiply these results across the organization.

Merger Integration

Most deals fail to achieve their promised value and executives identify integration as the most important factor. We help organizations address these challenges by drawing on 30+ years of experience guiding successful integrations with clients such as GE, Fidelity, JLG, and Merck.

While every integration varies, there are common elements to how we help companies accelerate ROI. We partner with leaders to define a comprehensive and specific picture of how the combined company will perform post closing – financially, strategically, operationally, and organizationally. We focus teams on delivering measurable results against each of these areas quickly, achieving cross-boundary synergies through rapid-cycle, 100-day projects. And we help clients recognize and address the very real cultural issues that often derail integrations.

The result is a process that greatly diminishes the risks inherent in any integration, and ensures that clients achieve significant growth and value from their acquisitions.

Operational Excellence

Many organizations strive to maximize operational effectiveness and efficiency. Some harness data to identify potential opportunities and train teams to pursue performance improvements. These are valuable drivers of incremental improvement but achieving step-change impact often requires a different strategy.

Some operational challenges are so complex that the standard quality management approaches are unable to move the needle. Leaders of various divisions and functions must be aligned around a common vision of success. Team members from across the organization must come together to understand root causes, and debate and prioritize solutions. And they must be empowered to implement their ideas quickly, in ways that minimize risk and maximize learning. No analysis paralysis. No reports without accompanying action.

Schaffer helps organizations break down silos to capitalize on major operational excellence opportunities. Our approach ensures that leadership agrees on priority outcomes and people closest to the work have the freedom to implement their best ideas. By focusing on rapid results and learning, we help teams build the capability to achieve breakthrough performance improvements.

Innovation

As organizations mature, processes emerge that tamp down peoples’ abilities to identify opportunities and go after them right away. Great ideas for incremental, adjacent, and disruptive innovation languish. More nimble competitors beat incumbents to the punch. We help clients avoid this pattern and empower their employees to spot and test innovations quickly – fast fail to minimize risk, or fast win and scale and expand results.

Schaffer helps leaders develop innovation strategies grounded in customer needs, facilitate rapid-cycle innovation sprints, and build their teams’ innovation capabilities. We teach teams to empathize with internal and external customers to better understand diverse perspectives. Schaffer helps clients to leverage those insights to design and facilitate fast, low-risk experiments that test the validity of potential solutions.

Our approach accelerates the pace of learning necessary to separate winning opportunities from lower-impact uses of time and resources.

Our Thinking

Making the Deal Real: How GE Capital Integrates Acquisitions

Successful Change Programs Begin with Results

Unlock the Value of Healthcare System Integration

Rapid Results: A Chapter from The Change Handbook

Surviving M&A: How to Thrive Among the Turmoil

Four Conditions That Leaders Create for Innovation to Thrive

Lessons of Scale

The Merger Dividend

Work-Out: A Chapter From the The Change Handbook

Why Good Projects Fail Anyway